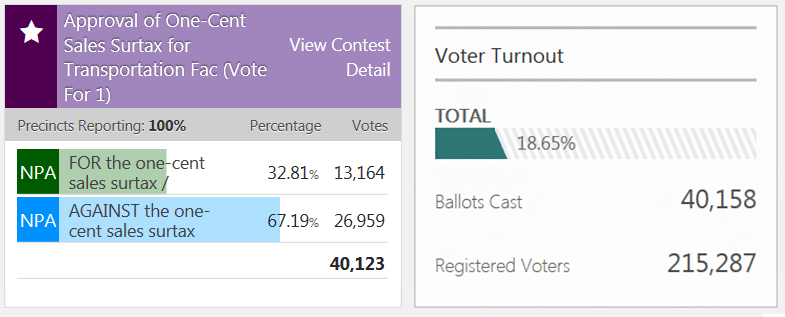

Election Results from the May 21, 2019 – One Cent Sales Surtax for Transportation

For more information, visit the Osceola County Supervisor of Elections office at www.voteosceola.org or click here

Special Election: May 21, 2019

Early Voting: May 13 – 19, 2019

A special election for Osceola County voters will be held on Tuesday, May 21, 2019 to decide a single ballot question:

Should transportation facilities and services be funded throughout Osceola County, including projects that improve roads and bridges, expand public transit options, fix potholes, enhance bus services, relieve rush hour bottlenecks, improve intersections, and make walking and biking safer by levying a one-cent sales surtax for 30 years?

For information on voting locations, early voting, or voting by mail, please contact the Osceola County Supervisor of Elections at

www.VOTEOSCEOLA.com or call 407-742-6000

Improve Infrastructure and Transit Systems

The proposed penny sales tax will allow us to improve roads and bridges, expand public transit options, fix potholes and enhance bus services.

Improve Pedestrian and Bicycle Safety, Reduce Congestion

In addition, it will allow us to reduce rush hour bottlenecks, improve intersections and make walking and biking safer by expanding and enhancing our sidewalks.

Maintain and Improve Emergency Response

When we are able to widen roads and improve intersections, our aim will be to reduce 911 response times for law enforcement and emergency vehicles such as ambulances.

Decrease Time in Traffic

This countywide plan will help us ease terrible rush hour bottlenecks, helping our residents get to and from work easier, get a child to a doctor’s appointment or just travel to the grocery store.

Strengthen Economic Climate Through Improved Mobility

By improving our mobility and easing congestion, our quality of life will improve and studies have shown that all of these things help increase property values, as well as our economy.

Invest in Local Roads for Future Generations

A significant portion of sales tax is paid for by tourists and visitors to Osceola County, so this is a way to make sure they are paying their fair share, as well.

FAQ's & Information

Updated 5-13-19 - May 2019 Board of County Commissioners - Community Presentation

Feb 18, 2019 Board of County Commissioners – Ordinance No. 2019-19

Mar 31, 2019 Sales Surtax Report – Dr. Hank Fishkind

May 6, 2019 Board of County Commissioners - Resolution No. 19-074R

May 6, 2019 Board of County Commissioners - Appendix A to Resolution No. 19-074R

Downloadable Brochure: (English) (Spanish)

March 19, 2019 - OPPAGA Audit

Osceola County was audited by Florida’s Legislature’s Office of Program Policy Analysis and Government Accountability (OPPAGA). This audit is part of the state's new transparency requirements for proposed sales tax increases.

Click here to review the final report and the county's response to the audit.

Community Meetings

Please check back for updated schedules of weeknight/weekend community meetings.

Monday – March 25, 2019 10:30AM – 11:30AM

Board of County Commission Chambers

Open House/Community Presentation by Osceola County staff

Monday – April 1, 2019 10:30AM – 11:30AM

Board of County Commission Chambers

Open House/Community Presentation by Osceola County staff

Saturday – April 6, 2019 1:00PM – 2:00PM

Osceola County Extension Services

Community Presentation and Meeting

1921 Kissimmee Valley Lane

Kissimmee, FL 34744

Monday – April 8, 2019 10:30AM – 11:30AM

Board of County Commission Chambers

Open House/Community Presentation by Osceola County staff

Monday – April 15, 2019 10:30AM – 11:30AM

Board of County Commission Chambers

Open House/Community Presentation by Osceola County staff

Monday – April 22, 2019 6:00PM – 7:00PM

Narcoossee Community Center

Community Presentation and Meeting

5354 Rambling Road, St. Cloud FL 34771

Monday – April 29, 2019 6:00PM – 7:00PM

Valencia College Poinciana Campus

3255 Pleasant Hill Rd

Kissimmee, FL 34746

Wednesday – May 1, 2019 6:00PM – 7:00PM

Celebration Town Hall

851 Celebration Avenue

Celebration, FL 34747

Wednesday – May 8, 2019 10:30AM – 11:30AM

Community Presentation

Hart Memorial Library

211 E Dakin Ave, Kissimmee, FL 34741

Thursday – May 9, 2019 6:00PM – 8:00PM

Osceola News Gazette Community Forum

Osceola County Administration Building

4th Floor BCC Chambers

1 Courthouse Square Kissimmee, FL 34747

The ballot will ask only one question:

Should transportation facilities and services be funded throughout Osceola County, including projects that improve roads and bridges, expand public transit options, fix potholes, enhance bus services, relieve rush hour bottlenecks, improve intersections, and make walking and biking safer by levying a one-cent sales surtax for 30 years?

______ FOR the one-cent sales surtax

______ AGAINST the once-cent surtax

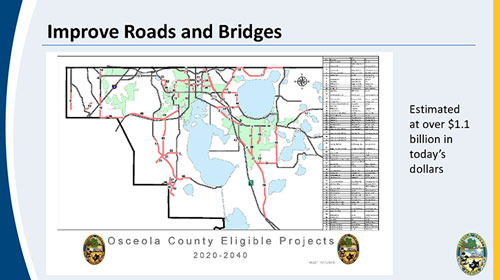

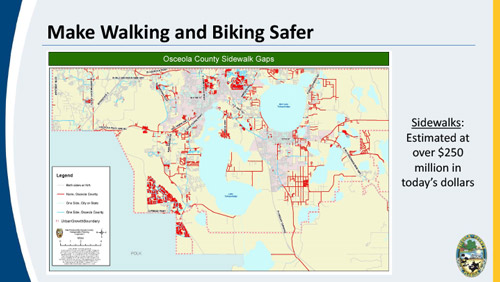

Right now, Osceola County has more than a $1.1 billion backlog of road construction needs. More than $250 million is needed to fill in existing sidewalk gaps, and $445 million is needed to build new recreational bicycle and pedestrian trails for residents. Additionally, surtax dollars will be used to relieve rush hour bottlenecks at key intersections and enhance bus services throughout the County. A one-cent surtax would improve and expand roads and public transit, significantly expand pedestrian and bicycle safety, reduce 911 response times, and provide a way for tourists and visitors to help pay for Osceola County’s transportation network.

A one-cent surtax will generate an estimated $67 million annually – or about $2.1 billion dollars over the next 30 years. A significant amount of that money will be paid by tourists and visitors. In addition to funding needed road improvements, the dollars will provide for critical pedestrian and biking safety projects, as well as additional investments in trails, technology to improve intersection operations, and vitally needed bus and transit expansion. The one-cent surtax will also boost the County’s road resurfacing budget from $9 million to $12 million each year – fixing more potholes and addressing other critical transportation maintenance operation needs.

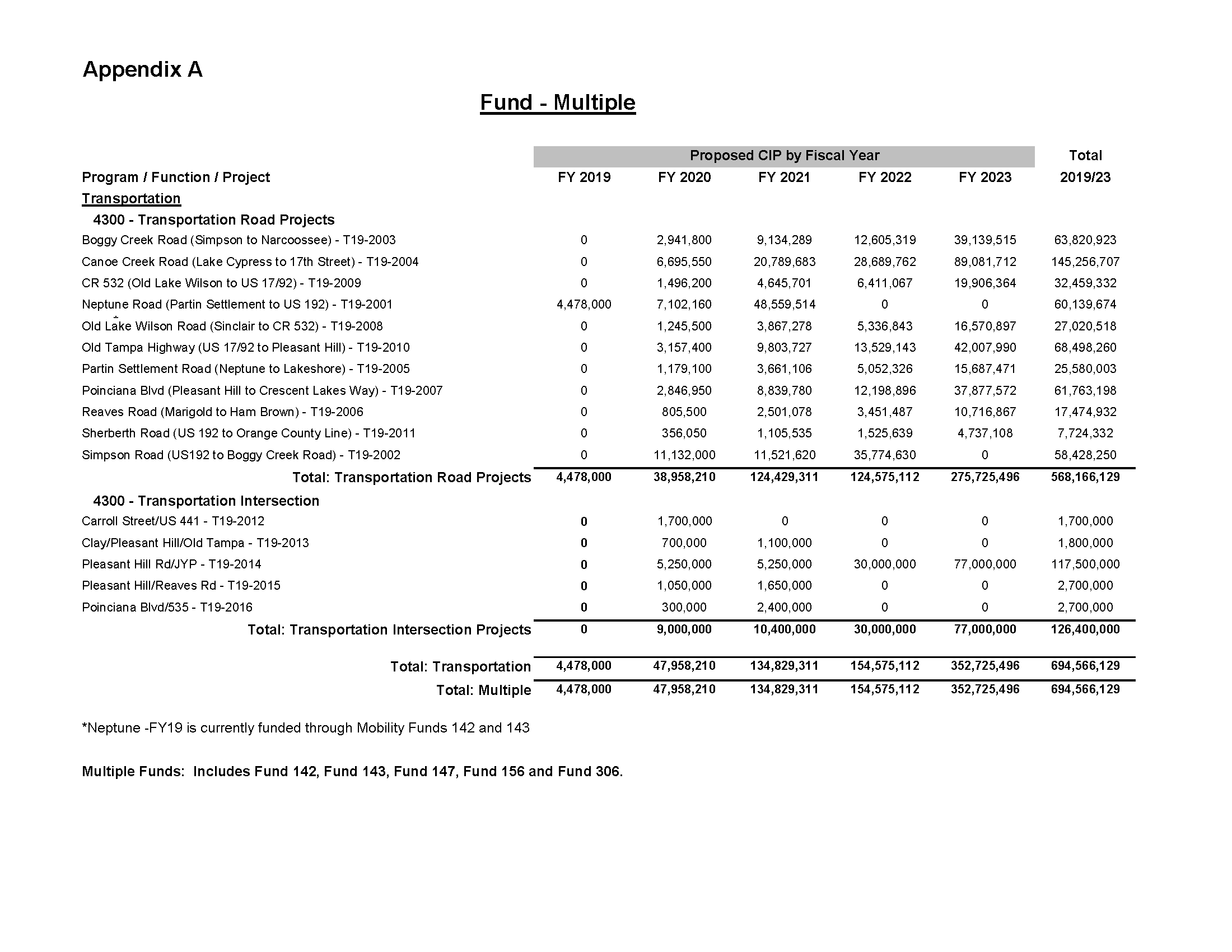

As stipulated by the Osceola County Board of County Commissioners in Resolution No. 19074-R, a dedicated local revenue source, such as the Transportation Sales Surtax, is essential to funding the development, construction and operation of additional transportation facilities and services in the County, which will insure the health, safety and welfare of the citizens. The Board has adopted Resolution No. 19-074R to identify its intent as it relates to spending of the proposed Transportation Sales Surtax proceeds and amending the 2019-2023 five-year Capital Improvement Plan as detailed in Appendix A (shown below).

USE OF TRANSPORTATION SALES SURTAX PROCEEDS

- Proceeds of the Transportation Sales Surtax shall be used for the purpose of funding transportation facilities and services in the incorporated and unincorporated areas of the County as permitted by section 212.005(1), Florida Statutes, as amended from time to time. Expenditures of said funds are further restricted to the specific uses identified in the ballot language as noted in Section 1 (B).

- Expenditure of the proceeds from the levy of the Transportation Sales Surtax shall be expended in accordance with the following:

- A minimum of 75% of the proceeds will be spent on activities that support the following items: improve roads and bridges, fix potholes, relieve rush hour bottlenecks, improve intersections, and make walking and biking safer.

- No more than 25% of the proceeds will be spent on activities that support the following items: expand public transit options and enhance bus services.

APPENDIX A

The one-cent transportation surtax will allow Osceola County to create a transportation network by fixing, building and expanding roads, as well as reducing congestion and gridlock through technology and the use of intelligent traffic signal coordination.

No, the surtax money will be used ONLY within Osceola County, including the cities of Kissimmee and St. Cloud. The surtax will not be used on toll road projects.

In 2015, the County Commission increased the gas tax by five cents per gallon, generating an additional average of $7.7 million per year. The money generated by the gas tax (2016 – 2018) has funded road resurfacing (31% of the money), transit services (29% of the money), and transportation capital projects (40% of the money). Prior to implementation of the gas tax, road resurfacing was funded at $3 million/year as compared to $9 million today and LYNX was funded at $6 million/year as compared to $7.6 million currently. Gas taxes, however, are a dwindling source of money with the proliferation of hybrids, electric cars and transit options, along with better mileage.

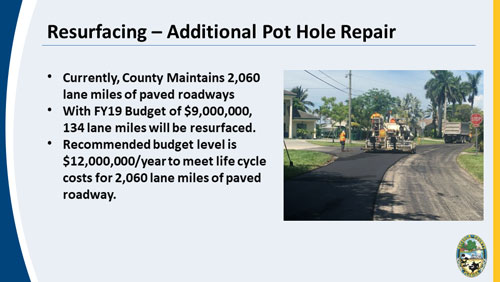

Prior to the implementation of the 2015 gas tax, Osceola County spent about $3 million annually in road resurfacing. This year, Osceola County is projected to spend a total of about $9 million. The surtax will increase that budget to approximately $12 million.

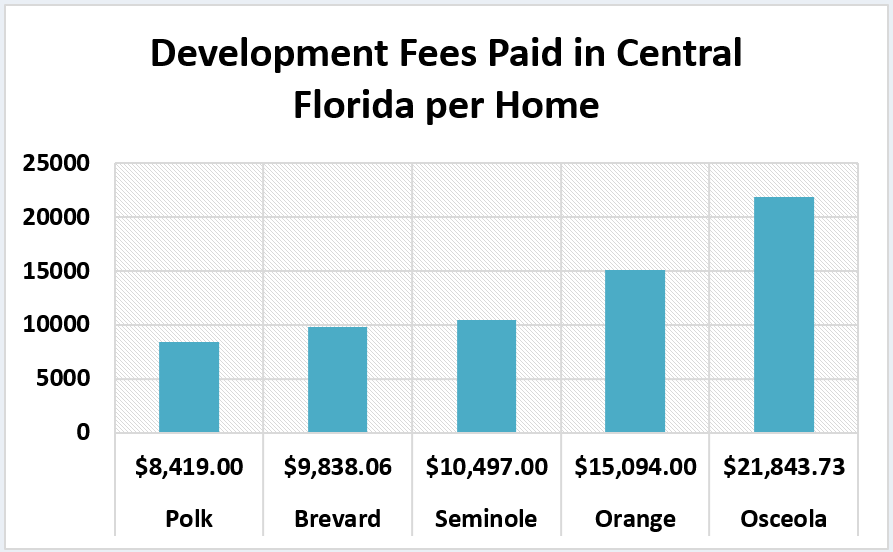

Osceola County is the second fastest growing county in the state, and will continue to welcome new families, businesses and jobs. Osceola County is making sure that developers pay their fair share. Osceola County nearly doubled the mobility fees paid by new development in 2017 and they are now the highest fees paid by developers in the region and among the highest in the state. Maintaining a healthy balance is important, too, to ensure that the cost of home ownership remains affordable for all Osceola residents.

In general, government charges fees to make sure that developers pay their fair share of the costs associated with new development, so that taxpayers are not burdened with the cost of things like new roads, new schools, new traffic lights and new parks. In Osceola County, developer fees are split into two categories. Mobility Fees are paid by developers for transportation-related impacts and Impact Fees are paid by developers for park, school, and fire impacts. Osceola County LEADS THE STATE in the mobility and impact fees that are charged for residential development.

The millage rate is the amount per $1,000 of property value that is used to calculate local property taxes. Source: www.floridarevenue.com

‘Save Our Homes’ limits the amount a homesteaded property can increase in value from one year to the next. After the first year a home receives a homestead exemption and the property appraiser assesses it at just value, the assessment for each following year cannot increase more than 3 percent or the percent change in the Consumer Price Index (CPI), whichever is less. The length of time a property has remained homesteaded by the same owner and the value of surrounding homes can impact the accumulated value of ‘Save Our Homes’. For more information, see section 193.155, Florida Statutes.

Improve Roads & Bridges

In addition to continuing construction on current projects such as Hoagland Boulevard, a list of eligible road projects is posted on the county's website at www.Osceola.org. With current funding, on average only one road project every 7 to 10 years is affordable. Funds from the surtax also will enable the County to leverage considerable state and federal grant dollars – money that now goes to other communities with the ability to match grant awards with local dollars.

In general, building new roads - or expanding and realigning existing roads – is budgeted at about $10 million per mile.

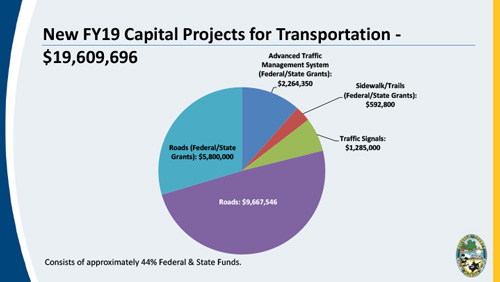

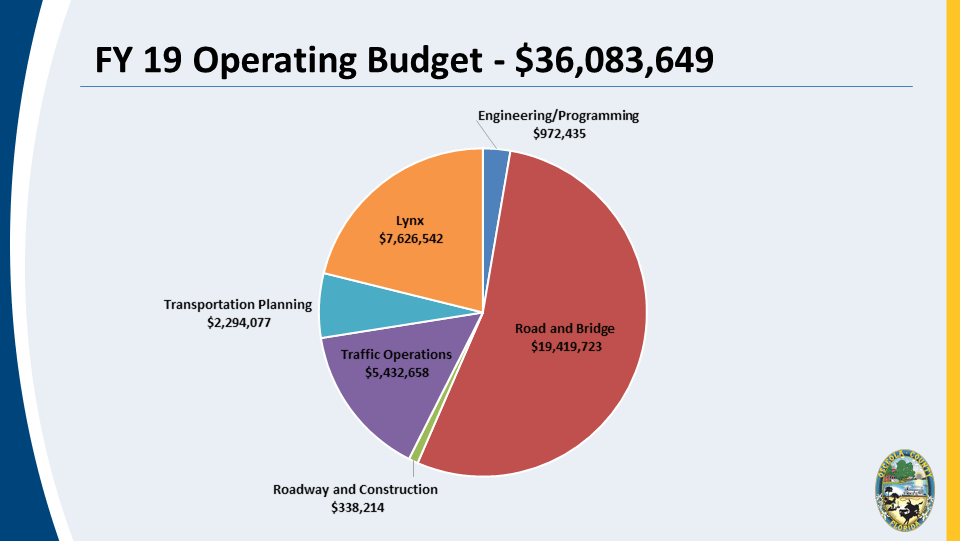

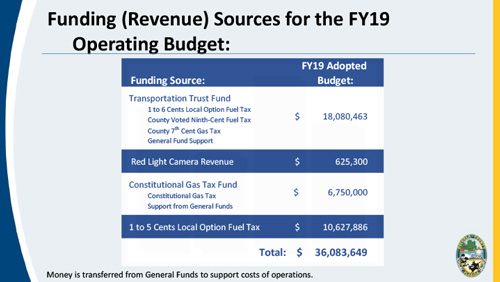

The transportation operations and maintenance budget for the current fiscal year (FY 2019) is shown in the chart below.

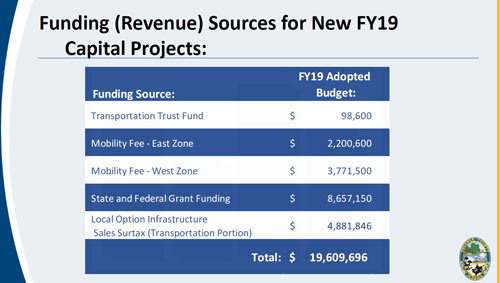

The operations and maintenance costs for transportation are currently funded from sources provided below.

Prior to the implementation of the 2015 gas tax, Osceola County spent about $3 million annually in road resurfacing. This year, Osceola County is projected to spend a total of about $9 million. The surtax will increase that budget to approximately $12 million.

Make Walking & Biking Safer

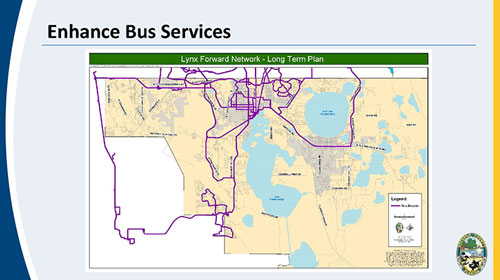

Expand Bus & Public Transit Service

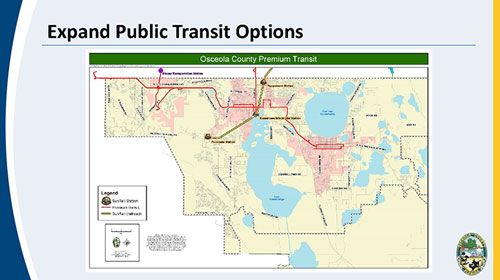

The surtax could be used to advance exciting new transit projects on US 192, utilizing autonomous vehicles or other emerging transit technologies. LYNX service could be improved, with new routes added.

The proposed surtax could be used for SunRail operations or for expanding SunRail service.