Finance and Budget Documents

This page provides links directly to our budget and finance documents including Annual Comprehensive Financial Reports, FY24 budget, FY23 budget, FY22 budget, and previous budgets.

Fiscal Year (FY) 2024 Budget Information

For the 14th consecutive year, the county’s general fund millage rate will not increase for FY2024. The overall proposed tax rate also remains the same as last year -- at 8.2308 mills for the general fund, EMS, library, and environmental lands. Although the millage rates did not increase, the Adopted Budget contains the necessary expenditures to maintain the delivery of exceptional services to the citizens and visitors of Osceola County while maintaining a focus on transportation, housing services, and public safety.

During the preparation of the FY24 Budget, the County property valuations reflected an increase over prior year by 16.4% which is a significant percent increase when compared to historical valuations. The Budget represents a continued effort to provide a high level of service to Osceola County residents, business owners, and visitors along with an investment in supporting infrastructure. This includes expanding the existing road network, adding additional resources to support the programs to help property owners and residents manage the historic inflationary impacts, and continued focus on Public Safety. The Adopted Budget is a balancing act between available resources and the demand of mandated and core local government functions, including the above public safety and transportation needs, alongside concentrated efforts to grow and strengthen the County with desired quality of life amenities.

Fiscal Year (FY) 2023 Budget Information

For the 13th consecutive year, the county’s general fund millage rate will not increase for FY2023. The overall proposed tax rate also remains the same as last year -- at 8.2308 mills for the general fund, EMS, library, and environmental lands. Although the millage rates did not increase, the Adopted Budget contains the necessary expenditures to maintain the delivery of exceptional services to the citizens and visitors of Osceola County while maintaining a focus on transportation, housing services, and public safety.

During the preparation of the FY23 Budget, the County property valuations reflected an increase over prior year by 16.91% which is a significant percent increase when compared to historical valuations. The Budget represents a continued effort to provide a high level of service to Osceola County residents, business owners, and visitors along with an investment in supporting infrastructure. This includes expanding the existing road network, adding additional resources to support the programs to help property owners and residents manage the historic inflationary impacts, and continued focus on Public Safety. The Adopted Budget is a balancing act between available resources and the demand of mandated and core local government functions, including the above public safety and transportation needs, alongside concentrated efforts to grow and strengthen the County with desired quality of life amenities.

Fiscal Year (FY) 2022 Budget Information

For the 12th consecutive year, the county’s general fund millage rate will not increase for FY2022. The overall proposed tax rate also remains the same as last year -- at 8.2308 mills for the general fund, EMS, library and environmental lands. Although the millage rates did not increase, the Adopted Budget contains the necessary expenditures to maintain the delivery of exceptional services to the citizens and visitors of Osceola County while maintaining a focus on transportation, housing services and public safety.

While property valuations increased, the impact from the COVID-19 pandemic is still unknown, as the revenue associated with property values lags two years behind. Together with the County’s main revenue sources and the COVID Relief funds; the budget attempts to address the needs of the community in accordance with Board priorities. This includes expanding the existing road network, adding additional resources to support the programs to help property owners and residents impacted by the pandemic and continued focus on Public Safety. The Adopted Budget is a balancing act between available resources and the demand of mandated and core local government functions, including the above public safety and transportation needs, alongside concentrated efforts to grow and strengthen the County with desired quality of life amenities.

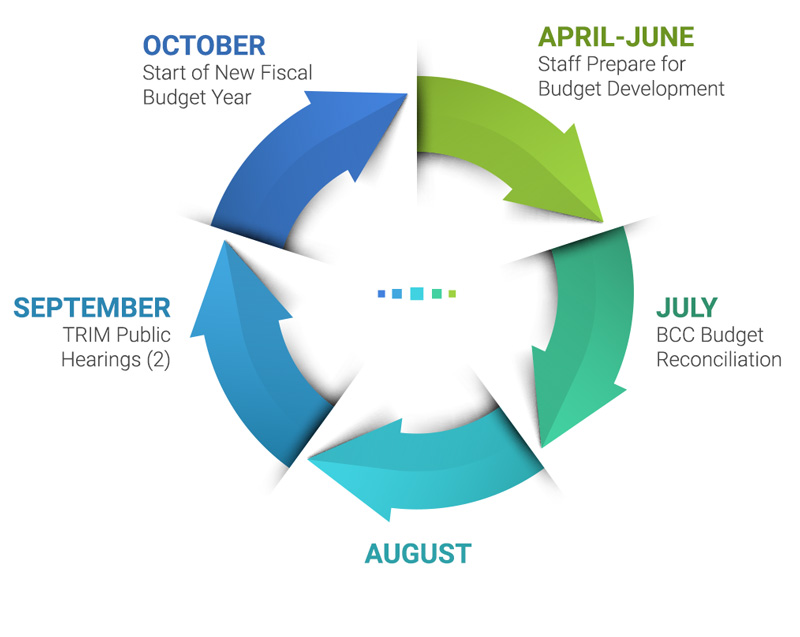

BUDGET PROCESS

The below chart represents the County's budget / program planning cycle.